Also, a donor need to maintain ample data in the unreimbursed expenses. See Publication 526, Charitable Contributions, for a description of records that could substantiate a donor’s contribution deductions.

founded in 2007, TaxSpanner is predicated out of latest Delhi. Since then, it's got grown to create pretty substantial client base During this current market segment.

For contributions of food stock in 2020, company taxpayers might deduct capable contributions of approximately 25 percent in their mixture Web income from all trades or companies from which the contributions were being created or up to 25 per cent in their taxable income.

Subscribe to our email checklist for the most effective sources in fundraising and leadership from Nonprofit qualified and our guardian sponsor, DonorPerfect!

You can also donate furniture and also other residence items to Habitat for Humanity. The Corporation resells these items in dwelling advancement shops — known as Habitat ReStores — and takes advantage of the money to fund its humanitarian attempts.

to guard your nonprofit Corporation and be sure that your donors have the required info, it’s critical to include all the elements shown over inside your tax receipts.

typically, the level of charitable cash contributions taxpayers can deduct on agenda A as an itemized deduction is limited to your percentage (ordinarily sixty per cent) in the taxpayer’s modified gross income (AGI). capable contributions will not be topic to this limitation.

Generally, the Income Tax Division problems the registration to get a limited period of time (of two several years) only. Thereafter, the registration needs to be renewed. The receipt need to not simply point out the Registration number but also the validity period of the registration.

Tax exemption in India refers to the relief granted by The federal government of India that enables people to exclude particular income or transactions from their taxable earnings.

IRS principles don’t let you deduct the worth of your time and efforts or assistance, but expenses connected with volunteering for a professional Firm can be counted as tax-deductible donations.

It's not necessary to contain possibly the donor’s social protection selection or tax identification amount on the acknowledgment.

Donation receipts, if finished effectively, are a major possibility to hook up with supporters and make them come to feel crucial. That’s where by personalization comes in.

Tax on employment and entertainment allowance will even be authorized donation to charity by company like a deduction from the salary income. work tax is deducted from your wage by your employer and after that it is actually deposited to the state government.

amount of money paid out to exploration companies conducting scientific investigate or any volume compensated to colleges, universities or other establishments for scientific analysis provided that the desired authority authorizes the quantity under portion 35(one)(ii).

Angus T. Jones Then & Now!

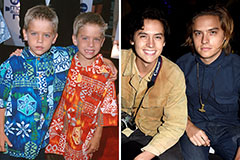

Angus T. Jones Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!